The numbers on credit card are used in transactions as a separate account number for each credit card globally. Understanding how many numbers a credit card has, the sequencing rules and the role of these numbers will help you use your card easily and smoothly and ensure confidentiality and safety.

1. Features to identify credit card number

Credit card number is a series of numbers usually consisting of 16 to 19 digits arranged according to a unique rule. Credit card in Vietnam consists of 16 digits. This series of numbers is like the “specific name” of each card and is used to make transactions in the global interbank system. Credit card number is embossed and located on the front of the card.

Remarks: This series of numbers is not an account number or a PIN code. Please bear this in mind to avoid confusion and trouble in the transaction process.

Credit card number consists of 16 digits and is embossed on the front of the card

2. Role of numbers on credit cards

The series of numbers on a credit card is not simply information on type of credit card (issuer), credit card number, but it also has many other useful roles and tasks. Specifically:

- Enable money transfer to credit card: Money transfer transactions to credit card can be done via ATM or convenient money transfer apps such as Mobile Banking, Internet Banking.

- Credit card balance inquiry: You just need to call Hotline of the issuing bank and provide the last 4 digits of the credit card and some required information. Then you can quickly know the remaining spending limit on your credit card to have a more suitable spending plan.

You can use a mobile app to transfer money to a credit card.

3. Other types of number on credit cards

In addition to credit card number (a series of 16 numbers), the cardholder needs to pay attention to the 3 digits on the back of the card. That is called card security code - CSC. CSC is the common name of CVC code (Mastercard verification code), CVV (Visa verification code) and CID (American Express verification code).

CSC needs to be highly secure because it acts as a layer of protection when making transaction and certifying card ownership for online payment. For online payment, you will not need to enter a PIN, just fill in your card information with CVV/CVC number to complete the transaction.

CVV/CVC - card security code you need to protect and avoid information disclosure

4. Some tips to protect your credit card

Securing your credit card numbers and other important information is the best way to protect your credit card account. This helps prevent credit card abuse and minimizes risks related to personal assets and interests. Here are some useful tips to protect your credit card:

- Remove CVV/CVC on your credit card

The CVV/CVC on your credit card can help you make transactions without remembering your password or PIN. Therefore, deleting this security code will help you avoid unexpected loss of money. Before deleting your CVV/CVC, write it down on your phone, notebook,... Then you blur the code by lightly scraping or pasting paper over it to cover the CVV/CVC.

- Sign on the back of your card

Your signature on the back of your card is like a security layer for your credit card. When making transactions, your signature on the invoice will be compared with the signature on the back of the card. If the signatures match, the transaction will be authorized. Otherwise, it will be rejected.

- Register for SMS Banking service

SMS Banking service will send a message containing an OTP for authentication every time you make any payment transaction. When there is a payment request, the system will send you a message. Thus, if you are not making any transaction, you can quickly contact the bank to lock your account, avoiding unauthorized money withdrawals.

- Do not lend your card to others

When you let others use your card, it is possible that your credit card information will be stolen and unauthorized transactions can be performed. Especially, in this case, it is very difficult for the card issuer to protect your interests. Therefore, you need to avoid giving your credit card to others.

- Register for Verified by Visa/MasterCard

Signing up for this service when shopping online is like an extra layer of protection for every credit card transaction. Verified by Visa/MasterCard service will send an OTP to your phone number and only when this OTP is entered correctly, your payment transaction will be authorized.

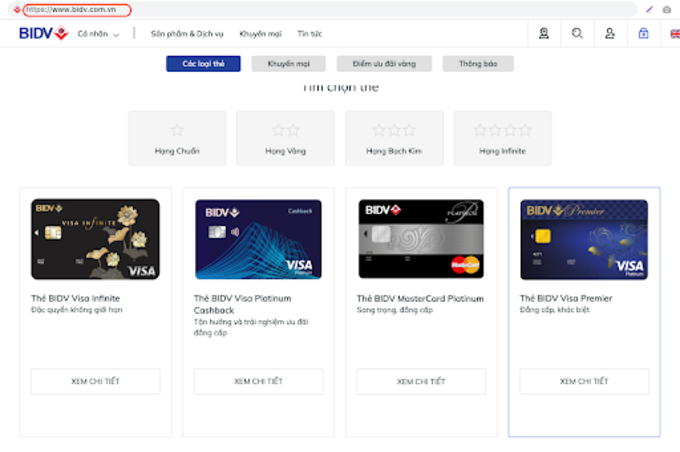

- Choose a reputable website when shopping online

Reputable websites have been encrypted to keep your information secure to avoid illegal penetration, abuse and information stolen from your credit card. A sign to identify reputable websites is the “https://” section

and a green lock icon on the domain name for safety.

You should choose reputable websites when shopping online to avoid having your credit card information stolen

Knowing about your credit card number, information and the role of 16 numbers on your credit card will help you use your credit card effectively and conveniently. If you have any questions regarding credit card numbers, please contact BIDV at hotline 1900.9247 for more detailed advice.