1. Definition of online banking

Online banking means a banking service that enables customers to use almost any banking product anywhere, at any time through Internet connection. This is a fairly broad concept, including Internet Banking, Mobile Banking or e-Banking....

Customers can use online banking anywhere, anytime

2. What services does online banking provide?

Online banking provides a plenty of convenient services to customers such as inquiry, fund transfer, payment, online savings, loans, card related features, among others.

- Inquiry: Online banking service enables you to query account information such as current account, deposit, loan, credit card, exchange rate, and interest rate and ATM/branch locations.

- Fund transfer:

- Internal transfer via account, card, mobile phone

- External transfer (normal transfer, 24/7 instant transfer via account/card)

You can make internal transfer, interbank transfer, bill payment, etc. and enjoy many other benefits when using online banking services

- Payment:

- Payment of utility bills, telecommunications charges (mobile phone, Internet), train tickets, air tickets, tuition fees, insurance premium, hospital charges, securities fees, tuition fees, loans, etc.

- Mobile top-up

- E-wallet top-up

- Online savings: Online savings deposit/withdrawal.

- Loan: Monitor loans and repayment process.

- Card related features:

- Card lock/unlock

- Online payment subscribe/unsubscribe

- Change of default current account

- Credit card payments for yourself and other cardholders

- Other features

- QR code payment

- Foreign currency selling

- Online shopping

You can make QR code payment through online banking

3. Who can use online banking services?

Online banking users can be individuals or businesses. Household businesses with 1 individual named on their business license can register as individual customers, household businesses with 2 or more people named need to register as corporate customers. Certain conditions should be met for registering online banking services.

3.1. Individual

- Vietnamese citizen or foreigner who is legally residing and working in Vietnam

- 15 years old or older

- Have full capacity for civil acts

- Have a valid ID card/citizenship card/passport

3.2. Enterprise

- Enterprises include the following types: Limited Liability Company, Joint Stock Company, Partnership, etc.

- Have a legal business registration license

4. Online banking - Pros and Cons

4.1. Pros

Compared with traditional banking, online banking has many outstanding advantages in terms of convenience and processing speed, helping simplify customers’ financial transactions:

- Convenience: Customers can access and use the service anywhere, any time, as long as there is an Internet connection without having to visit a bank branch.

- Quick, efficient transactions: Whether it’s an internal or interbank money transfer, transactions are carried out quickly.

- Easy to track: Thanks to the inquiry feature, users can monitor and control information related to their account every day. As a result, you can promptly detect signs of fraud and security risks, which should be immediately flagged to the bank for timely solution.

4.2. Cons

Online banking services still have some minor disadvantages as follows:

- Certain transaction limits are imposed by day, by month and by transaction, so it is quite troublesome in case you need to make a high value transaction.

- Stability somewhat depends on the Wi-Fi/3G/4G network system (sometimes there are network errors, leading to transaction disruption or failure to display transaction information...)

Online banking enables users to make quick, convenient transactions

5. How to open online banking account

5.1. Conditions to open online banking account

To use online banking services, you must open an account at a bank that provides E-banking services, then follow the registration procedures according to the regulations of each bank.

5.2. How to register online banking services

To use online banking, you can choose one of two options below:

- Option 1: Register directly at the bank’s counter

- Please visit your nearest bank branch/transaction office to register for the service. The bank staff will directly advise and guide the steps to be taken.

- After successful registration, you can make all transactions easily and conveniently according to the bank’s regulations.

- Option 2: Register online (if banks support this type)

- This type of registration is only for customers who already have bank account but do not have online banking services.

- Users access the bank’s website and fill in necessary information following the instructions on the website.

In addition, a few banks have applied eKYC, allowing customers who do not have bank account to register online immediately without visiting the counter.

With online registration, you can register to use online banking at home or anywhere without visiting the counter

6. Overview of BIDV online banking

6.1. Features of BIDV online banking

At BIDV, online banking service has taken a step further when transformed into the new generation digital banking service - BIDV SmartBanking, by combining Internet Banking and Mobile Banking services.

In addition to basic features for fund transfer and payment, BIDV’s digital banking service also possesses many outstanding features, helping to enhance customer experience.

- Basic Features

- Online money transfer (waiver of transfer fee and many other fees when signing up for B-free package):

-

- Internal transfer via account, card, mobile phone

- External transfer (normal transfer, 24/7 instant transfer via account/card)

- Donation

- Gift presentation (for new year, birthday, opening ceremony, etc)

- QR code fund transfer

- Online savings/withdrawal with competitive interest rate

- One-off or auto bill payment

-

- One-off bill payment: Electricity, water, telecommunications, ADSL, air tickets, phone top-up for all mobile carriers in Vietnam, e-wallet top-up including Momo, ShopeePay, Truemoney, Zalopay, Moca...

- Set periodic auto payment orders for electricity, water, telecommunications, television, and tuition fees

- Pay domestic tax, registration tax, social insurance, seaport infrastructure fee

- Mobile phone, e-wallet top-up

- Card services

- Card lock/unlock

- Online payment subscribe/unsubscribe

- Change of default current account

- Credit card payments for yourself and other BIDV cardholders

- Medical card top-up

- QR-based ATM withdrawal without using physical card

- PIN change

- Online card issuance

With BIDV SmartBanking, you can withdraw cash at ATM by scanning QR code

- Online foreign exchange

- Loan account service: Quick loan, loan/repayment monitoring

- Inquiry

- Account information inquiry (payment, deposit, loan)

- Credit card information inquiry

- Exchange rate, interest rate inquiry

- ATM/branch location look-up

- Mailbox: send a request for reconciliation/charge-back, etc,

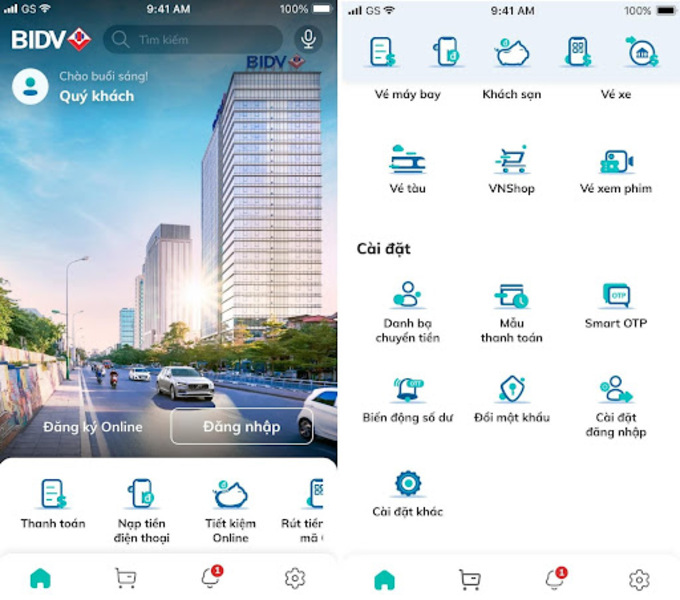

- Features: Sign up for Recurring Money Transfer, Recurring Bill Payment, E-wallet, Online Charge-back, Ticketing Service (Air tickets, hotels, bus tickets, train tickets, movie tickets, VNShop), ATM/Transaction Point look-up, Exchange rate/Interest rate inquiry…

- Setting: Transaction limit, Sign up for a service package to get waiver of transaction fee and many other fees, Authentication method, Login with Fingerprint/Face ID, Avatar/wallpaper, Language, Login security settings for Internet Banking.

- Other services such as Personal Financial Management, helping customers manage their personal expenses simply and clearly;

BIDV SmartBanking interface

- Distinctive features:

- Register online by e-KYC

- e-KYC is an electronic know-your-customer solution that allows banks to identify customers 100% online based on biometrics without having to meet face-to-face like the traditional process.

- Modern e-KYC helps customer to open a bank account without visiting the bank’s counter. It takes only a few minutes for registering, authentication and 100% online identification, then you can have an account right away without any further procedures at branch/transaction office.

- Personalize your avatars, wallpapers, features as you wish, support to save beneficiary contacts for instant money transfers, personal financial management function to effectively track income and expenditure, gift giving (money transfer with personalized greeting cards).

- Unify 1 username 1 password for multiple platforms including website, mobile, smart watch, and smart keyboard.

- Diverse ecosystem with nearly 2,000 services from payment of utility bills, tuition fees, to buying movie tickets/air tickets/train tickets, online shopping, etc.

- BIDV SmartBanking is the only app on the market which is tailored for smart watches and smart keyboard (allows transactions right on chat UI such as Zalo, Viber, Messengers,... without switching back and forth between apps).

BIDV SmartBanking brings many new features to enhance customer experience and services

6.2. Advantages of BIDV SmartBanking

- Time-saving: Simple operations and specific instructions help users quickly get used to the app.

- 24/7 transactions, anytime, anywhere: Users can access and use BIDV online banking service anywhere, at any time using a personal computer or mobile phone, as long as there is an Internet connection.

- Safety & security: BIDV Online Banking uses a completely secure two-factor authentication mode.

- Instant money transfer: BIDV provides money transfer services within the BIDV system, domestic money transfer, 24/7 interbank instant money transfer, and scheduled money transfer.

More: Instructions for use of BIDV SmartBanking

6.3. How to register for BIDV SmartBanking

To register for BIDV SmartBanking, customer can apply both traditional way and e-KYC:

- Option 1: Register at BIDV’s nearest counter

- Option 2: Register online here (applicable to customers who already have a BIDV account) or on BIDV SmartBanking app (verify by questionnaire or ATM card PIN)

- Option 3: Register online using eKYC for customers who do not have an account at BIDV. For this option, you need to prepare identification documents such as ID card, Citizen ID card, Passport and follow the below steps:

- Download SmartBanking app on the application stores (App Store, CH Play) and select the “Register” menu on the home screen of the app.

- Follow the on-screen instructions including taking a photo of both sides of your ID card, taking a self-portrait, and filling in some information as required.

- Instruction video for registration using eKYC: https://youtu.be/jLVrHXMcuTU

Download BIDV SmartBanking on mobile:

We have gone through all useful information you need to know about online banking in general and BIDV’s online banking services in particular. If you want to learn more about the definition of online banking and benefits of BIDV SmartBanking, please visit here or contact our hotline 1900 9247.